Online shopping has become an essential part of our lives, offering convenience and competitive pricing. However, choosing the right payment method is crucial to ensure security and avoid financial fraud. Many users still rely on Debit and Credit Cards, but these traditional methods come with risks. This guide explores the safest online payment options with a focus on technology, security, and digital transactions.

Quick Links

Why Choosing a Secure Payment Method Matters?

When making online purchases, your personal and financial data is at risk. Cybercriminals use phishing, skimming, and hacking techniques to steal sensitive information. Hence, it’s essential to use a secure payment method that minimizes risks and offers buyer protection.

Top Secure Payment Methods for Online Shopping

We have listed all the option with that you can safely do online shopping without losing your money:

1. Cash on Delivery (COD) – The Safest Option

- Risk Level: (Very Low)

- Why It’s Safe? No banking details are shared.

- Drawback: Limited availability, not feasible for digital products.

If security is your primary concern, COD is the safest option as you pay only after receiving the product. However, this method is not available for digital goods and international purchases.

2. UPI (Unified Payments Interface) – A Secure & Fast Option

- Risk Level: (Low)

- Why It’s Safe? No need to share card details; transactions require authentication.

- Best For: Domestic transactions in India.

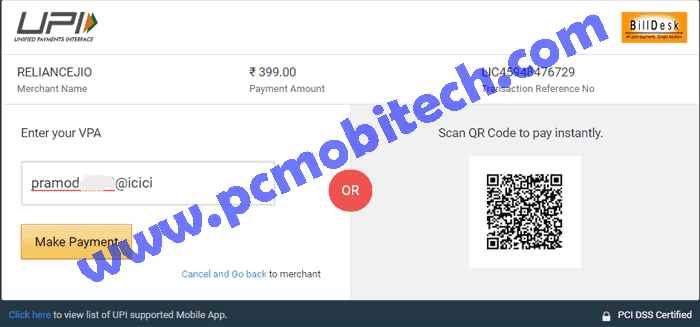

UPI is a revolutionary digital payment method in India that allows instant transactions without exposing your card or bank details. Popular UPI apps include:

- Google Pay

- PhonePe

- BHIM

- Paytm UPI

Each UPI transaction requires authentication via mobile number and UPI PIN, making it highly secure. If you use UPI ID (VPA) instead of your bank details, it further reduces the risk of fraud.

3. PayPal – The Best International Payment Solution

- Risk Level: (Low)

- Why It’s Safe? Buyer protection and no direct sharing of card details with merchants.

- Best For: International transactions.

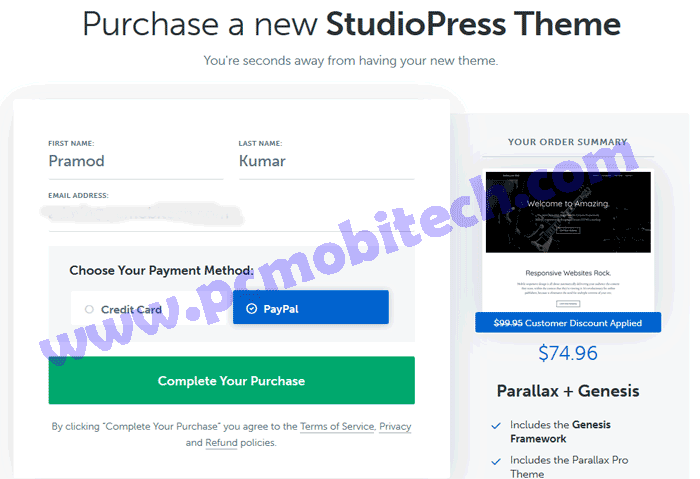

PayPal is widely accepted across global e-commerce websites. It acts as an intermediary between your bank/card and the merchant, ensuring a secure checkout. PayPal also offers 180-day purchase protection, allowing you to claim a refund if you receive a defective or wrong product.

Read: How to Signup PayPal For Free Individual Account.

4. Digital Wallets (Google Pay, Apple Pay, Amazon Pay, Paytm Wallet, etc.)

- Risk Level: (Low)

- Why It’s Safe? Transactions are encrypted and tokenized.

- Best For: Secure and fast checkout.

Digital wallets store your payment details securely and use tokenization technology, which replaces actual card details with a secure digital token. This reduces the risk of fraud. Popular options include:

- Google Pay (for Android users)

- Apple Pay (for iPhone users)

- Amazon Pay (for faster checkout on Amazon)

- Paytm Wallet (for Indian users)

5. Net Banking – A Secure Alternative to Cards

- Risk Level: (Low)

- Why It’s Safe? Direct bank-to-merchant transactions without storing card details.

- Best For: Users who don’t use wallets or UPI.

With Net Banking, transactions are authenticated via OTP (One-Time Password) and 2FA (Two-Factor Authentication), making them highly secure. However, users should avoid logging into banking portals from public computers or insecure networks.

6. Debit & Credit Cards – Secure Only With Extra Precautions

- Risk Level: (Moderate)

- Why It’s Risky? Card details can be stolen if the merchant site is not secure.

- How to Stay Safe? Enable 3D Secure PIN, set spending limits, and use virtual cards.

While Debit and Credit Cards are widely used, they are also the most targeted by hackers. If you must use them, follow these security tips:

- Use Virtual Credit Cards (VCC) for one-time transactions.

- Enable 3D Secure PIN (Verified by Visa, MasterCard SecureCode).

- Set daily transaction limits for better security.

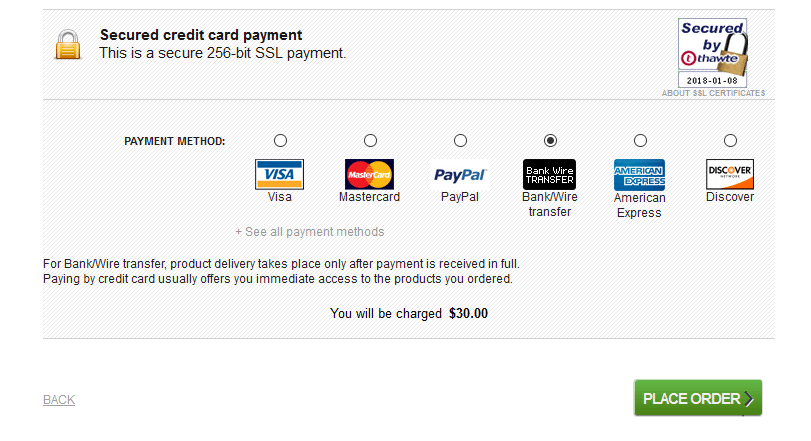

7. Wire Transfers (NEFT, IMPS, RTGS) – Secure But Slow

- Risk Level: (Moderate)

- Why It’s Safe? Direct bank-to-bank transfer without card details.

- Drawback: Slower processing time and difficult refund process.

Some merchants accept payments via NEFT, IMPS, or RTGS, which are direct bank transfers. These are secure but less convenient, as refunds take longer if issues arise.

Also See:

Final Verdict – Which is the Safest Payment Method?

The best payment method depends on your needs. However, from a tech and security standpoint, these are the top recommendations:

| Payment Method | Security Level | Best For |

|---|---|---|

| COD | Very Low Risk | Physical product purchases |

| UPI | Low Risk | Instant domestic payments |

| PayPal | Low Risk | International transactions |

| Digital Wallets | Low Risk | Fast and secure transactions |

| Net Banking | Low Risk | Direct bank transfers |

| Debit & Credit Cards | Moderate Risk | Widely accepted, use with caution |

| Wire Transfers | Moderate Risk | Large transactions, business payments |

To maximize security, always use two-factor authentication (2FA), enable transaction alerts, and avoid storing your payment details on e-commerce sites.

Which online payment method do you prefer for secure transactions? Let us know in the comments!

When you purchase through links on our site, we may earn an affiliate commission. Read our Affiliate Policy.

How do I make sure that I receive the product if I make a payment through Paypal? What if the seller decides to keep the money that I paid through Paypal and do not ship me the goods?

Paypal offers 180 days money refund policy under the Paypal buyer protection. If seller doesn’t deliver the product, you can claim your money back. Read More