Online banking transactions have made financial management convenient, but they come with security risks. A single mistake can lead to financial loss or data theft. To ensure safe transactions, follow these essential security tips.

How to Stay Safe When Doing Online Transactions

Here are some crucial steps to protect your online banking activities:

1. Never Share Sensitive Account Information

- Do not share User ID, Password, OTP, URN, Debit/Credit Card Grid values with anyone.

- If someone asks for your banking details over phone, email, or online, never provide them.

- Banks never ask for sensitive details through calls, emails, or messages.

Must See:

- What Is the Difference Between 5G, 4G, AND 3G?

- 10 Debit Card Safety Tips.

- How to Secure Last Password account & all password.

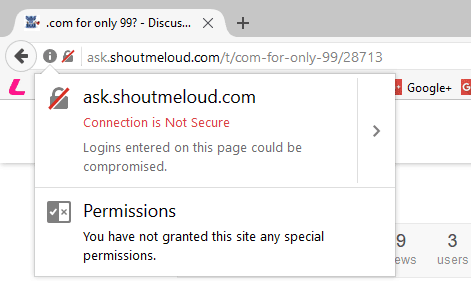

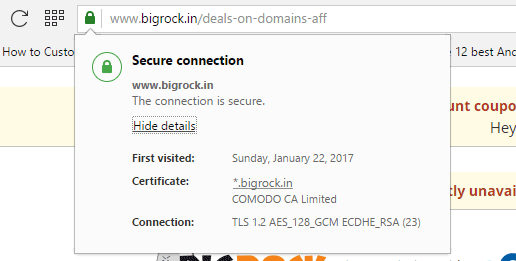

2. Use Only Secure Websites for Transactions

- Always check for HTTPS in the website URL before entering banking details.

- Secure sites display a padlock icon in the address bar.

- Avoid making transactions on public Wi-Fi or unsecured networks.

3. Register for Instant Alerts

- Enable SMS and email alerts for every transaction.

- If you receive a transaction alert you didn’t authorize, immediately contact your bank to block access.

4. Monitor Your Banking Transactions Regularly

- Regularly check your account statements for unauthorized transactions.

- If you find any suspicious activity, report it to the bank immediately.

5. Use Official Banking Apps

- Download banking apps only from official sources like Google Play Store or Apple App Store.

- Official banking apps offer secure login options like fingerprint, OTP, and Face ID authentication.

6. Install Strong Antivirus Software

- Use premium antivirus software on your devices to prevent malware attacks.

- Keep your antivirus updated to protect against the latest threats.

- Avoid using cracked or free antivirus software, as they might be compromised.

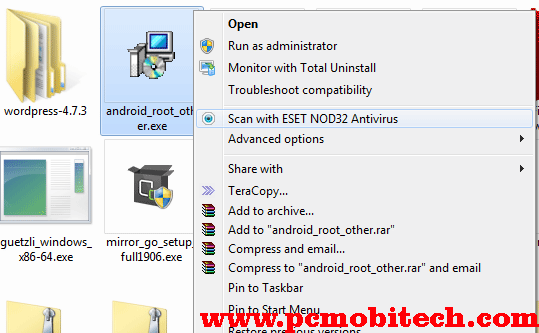

7. Scan Downloaded Files for Viruses

- Before opening movies, videos, music, documents, games, or software, scan them for viruses.

- A good antivirus performs real-time scanning to detect threats before they can harm your system.

8. Report Unauthorized Transactions Immediately

- If you suspect that your bank details have been hacked or notice unauthorized transactions:

- Contact your bank’s customer care immediately.

- Request to block your account or card to prevent further misuse.

- File a complaint with the bank and follow their guidance for recovery.

Final Thoughts

Online banking is safe only when proper precautions are taken. Follow these tips to minimize security risks and protect your financial data.

Have you faced any banking security issues before? Share your experience in the comments!

When you purchase through links on our site, we may earn an affiliate commission. Read our Affiliate Policy.