The ICICI Bank mobile app, Pockets, is a digital wallet for your online transactions. The Pockets app allows you to send money, recharge your mobile, pay bills, buy movie tickets, shop anywhere, split expenses with family and friends, and much more. Pockets is a virtual Visa-powered card with which you can make online transactions on any website or mobile application. It works all over India. ICICI Pockets application users can also apply for a physical card, which you can use at any retail outlet.

Pockets is a digital wallet and functions like a savings bank account. Therefore, you can also send money to any Pockets wallet, bank account, or friends’ contacts. Transfer money to any bank with NEFT service and transfer Pockets app money to your own ICICI bank account. Add or manage payee names, create a fixed deposit – everything you can do in the Pockets app. This app is for everyone; it means any person can use this app. It is not necessary to have an ICICI Bank account. The Pockets app is available for Android and iPhone.

Activate ICICI Bank Mobile Banking App Pockets on Android or iPhone?

For the activation of your Pockets app, a message will be sent from your smartphone. Therefore, it is necessary to first select the mobile number registered with your bank account.

Note:

For older Android OS, Pocket app activation requires setting up the default SIM for SMS. Go to your smartphone Settings >> Dual SIM Settings >> Messaging and select your ICICI Bank registered SIM (In Android 6.0 Marshmallow and Android 7.0 Nougat, go to Settings >> More Connection settings >> Sim Card Manager >> Text Messages). Now, when the Pocket app sends a verification message, it will automatically send from your registered mobile number.

Follow these easy steps below if you’re an ICICI Bank Customer:

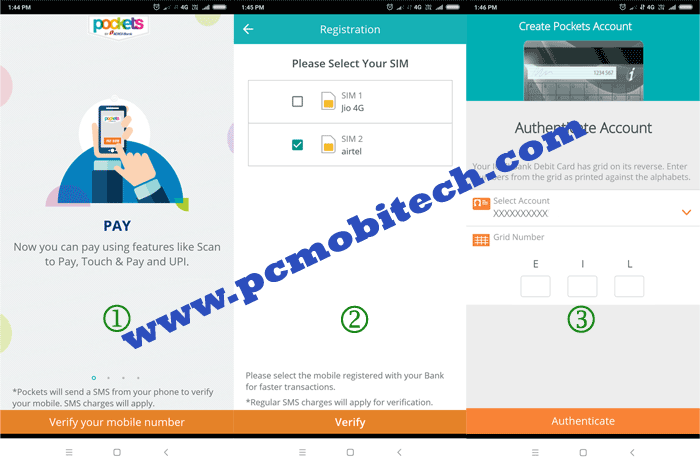

- Open the Pockets app on your smartphone. When the application loads, the “Pockets By ICICI Bank” screen will appear.

- On next, you will need to Authenticate your Device (Verify your phone number) enter your mobile number which is registered in your bank branch. And tap on Verify Your Mobile number option.

- The app will prompt you to select the SIM card with which you want to register your Pockets app. If the screen doesn’t appear in some older Android OS versions, please refer to the above-described note to avoid registering with the wrong mobile number. If the screen is visible, choose the preferred SIM and tap on the “Verify” button.

- After tapping “Verify,” the Pocket app will send an SMS via the selected SIM. You will receive a confirmation message on your registered mobile number. For Android MarshMallow or below versions where the default SIM for SMS or messages is not set up, a “Failed to verify mobile number” screen may appear. In this case, click on “Proceed” to verify the mobile number manually by sending the verification code via your registered mobile number. After successful verification, you will see the “Authenticate Account” screen.

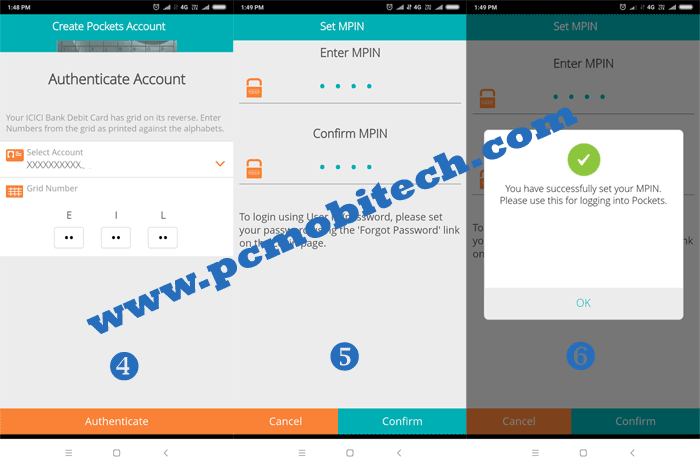

- On the “Authenticate Account” screen, verify your ICICI Bank debit card grid number (found on the back panel of the debit card). Enter the 2-2 digit number and tap on the “Authenticate” button at the bottom of the screen. If the grid number is correct, you will see the “Set M-Pin” screen.

- Set an M-Pin for your Pocket app login by entering and re-entering a 4-digit mobile pin (e.g., 6254). Note that this is not your ATM PIN. After creating the M-Pin, you will receive an on-screen message stating, “You have successfully set your M-Pin. Please use this for logging into Pockets.”

- After Creating MPIN, You will receive an on-screen message- “You have successfully set you MPIN. Please Use this for Logging into Pockets”.

- Congratulations! You have successfully activated the ICICI Bank Pockets app.

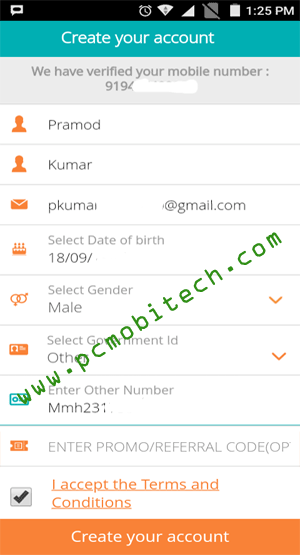

Note: This process is applicable only for ICICI Bank customers. If you are not an ICICI Bank customer, you must fill out an account creation form after SMS verification.

For non-ICICI customers wishing to use the app, fill out the account form. After activating the Pocket account, complete the KYC form. Failure to fill out the KYC form will result in the Pocket app working for only one year, after which the account will be closed.

Also See:

- How to use BHIM App & transfer Money to others account.

- How to Activate PayTm App and add fund to wallet.

How to Add Fund To Pockets app?

To use your Pockets wallet, it is necessary to add funds to your Pockets account.

- After logging in with your M-Pin, a welcome message will appear. “Welcome to Pockets! Get started by funding your wallet!” Tap on “OK” to add funds. If you don’t want to add funds yet, tap on “Cancel.” You can also add funds later.

- On the next screen, enter an amount and tap on the “Next” option at the bottom.

- Now, you will see the “Add Funds” screen and four options:

Linked ICICI Bank account – It’s the easiest way. If you have some money in your account, you can transfer it to your Pockets wallet account. Just tap on the “Linked ICICI Bank account” option. You will see “Add funds from” options: Account number, Amount, Deal, and at the bottom, the “Add Funds” option. Tap on the “Add Funds” option to add funds to your Pockets. You will receive an OTP (One Time Password) as soon as the message comes. The Pockets app will automatically detect the OTP and fill it up. Tap on “Confirm” to confirm the OTP. After verification, your funds will be added to your Pockets account.

Debit card/Netbanking – You can add funds from your other bank accounts, through Debit card and Netbanking services.

Cash Deposit at ICICI Bank branch – You can also deposit cash at the bank counter. Fill up the cash deposit slip and deposit cash at the counter.

NEFT from other banks – Transfer funds through NEFT from other bank accounts. Log in to your bank’s internet banking, add your Pockets wallet as a payee by entering the 16 digits Pockets card number, select the bank as ICICI BANK, and enter the IFSC CODE – ICIC0001022. Now you can transfer funds to the added payee using NEFT.

Thank you for visiting.

~ If you encounter any problems or have suggestions, please leave a reply in the comment box ~

When you purchase through links on our site, we may earn an affiliate commission. Read our Affiliate Policy.

POCKETS APP INSTALLATION ENDED BY ERROR.

Sorry we are unable to process your request at the moment.Please try again after a while. (#119)

It hangs after Mobile no verification. even sms received from bank confirming verification

While trying to add funds to pockets.. I’m getting message saying “As per RBI mandate, your pockets wallet has been disabled for further credits. Please complete kyc for enabling credits”. On clicking the button ‘Proceed to KYC’, I get another message.. “Hey, your account is already kyc complaint”. How can I add funds to pockets?

I’m a icici bank credit card customer and I linked my HDFC account to pockets via a upi id. Anything else required?

‘verify your phone number’ page.

after this page i cannot go ahead any further, can u suggest

all other upi apps got registered but pockets is stuck there

When I want to add money it says invalid card status

SMS varification not support my mobile.how can activate my app?

I accidentally closed my pocket wallet. Is there any to reactive it?

How to change mobile number?

Not able to open account. Tried more than 20 times.. showing #111 error.. imobile is worst pocket I have ever seen :/

Pockets suck, couldn’t log in ever

You should report to app developer.

Transactions and deposits has been stopped.since I have created an account one day before. What was the problem I am facing.even adding of new payee is also getting stopped

Whenever I try to login from mobile app, it says error code 215, try later.

And if I try from internet banking, it says error mobile no exists. Customer care could not help

Try to reinstalling iMobile app.

POCKETS APP INSTALLATION ENDED BY ERROR.

Sorry we are unable to process your request at the moment.Please try again after a while. (#119)

Dear Team please find below statement

Your fund transfer for INR 1,564.00 on 25-07-17 is declined as the beneficiary Account no or IFS Code is invalid (IMPS Ref no. 7206191XXXXXXX).

Dear Nirav you have entered wrong IFS CODE, Double check the difference between 0 (Zero) or O. And if you’re still facing any problem then call to customer care or Bank Branch.

what are the fund transfer charges from pockets to an bank account?

After entering Mpin and Confirm Mpin , I am not getting the message ‘You have successfully set you MPIN. Please Use this for Logging into Pockets”.’

Instead I am getting different msg (There was an error setting mpin please try again later), this was observed every time and I stopped installing the app.

Thanks,

Ravi

Dual SIm verify mobile (not happening)

You Number Should be in Sim1

How does Tap N pay work for Send Money option?

Can you please outline the steps up to the point transaction is completed?

THanks in advance

I have no internet on registered mobile. But have internet on other sim can I use this app?

Yes You can.

While going to sent MPIN for Pockets, I got the message as “There was an error setting the Mpin. please try again later. even though, I gave correct mpin #s, I got this message. So I am unable to login(even though, If I give user name and correct password, it won’t allow me to login. please give solution for this.

Use password reset option.